Week 3: JP Morgan's AI Journey

Lessons in Future Readiness

So, here I am in week 3 of my Claude-created learning plan journey. I think I’m behind.

These weeks I am focusing, according to my plan, on the Finance Industry and diving deep into use cases. One thing that captured my attention was JP Morgan's AI journey. They seem to be leading the charge on AI implementation, with a wealth of information available from analyst reports to shareholder presentations.

Here's what's interesting: JP Morgan began this journey several years ago (I’ve heard they began planning around 2013, but now I can’t find that source). By 2017, they had “already” started moving applications to the cloud—but only after spending two years analyzing those applications for risk, cost, and regulatory requirements (WSJ).

In 2017, then-CIO of JPMC Dana Deasy told the Wall Street Journal that “he sees bigger potential in making developers more efficient and in employing technologies such as machine learning and microservices that make it easier to run applications on any platform.”

As someone who led cloud transformations during my time at Pivotal, I can tell you what that often entailed:

Transitioning from on-premise, monolithic architectures to cloud-native microservices

Creating Continuous Integration/Continuous Delivery pipelines

Implementing Test Driven Development

And then there’s the cultural piece and the discomfort from some folks when it comes to new technology. There was plenty of it—from those who felt threatened by the new way of doing business, to leaders who saw massive investment without immediate returns. Using a crystal ball to see into the future would be so nice, but more on that later.

According to a recent MIT Sloan Management Review article, companies need to prepare for the future by:

Modularizing their internal systems

Identifying core strategic capabilities to build upon

For the financial industry, this means maintaining customer trust through secure transactions and remaining a reliable financial partner for individuals and businesses alike.

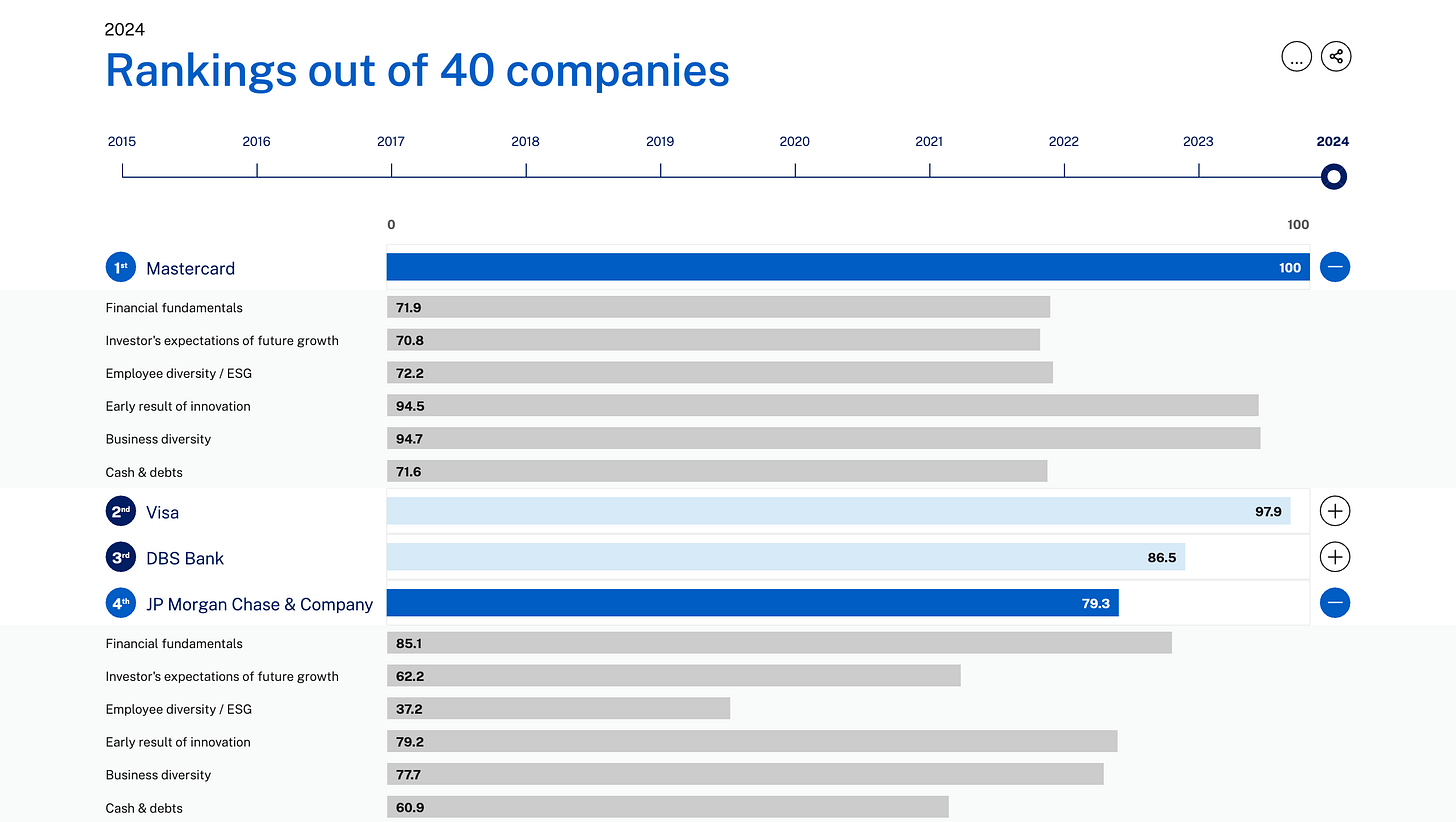

In order to keep up with the evolutionary and explosive movement of AI and ML (a technology growing at an exponential pace, as Azeem Azhar eloquently points out), companies must be future-ready. JP Morgan is definitely on the leaderboard, though only at #4 according to IMD's Future Readiness Indicator.

Key Areas for ROI

Where are companies in the banking industry seeing the greatest returns? While a lot of attention has been given to GenAI and other Deep Learning technologies, the greatest returns are coming from the “boring,” less-glamorous side of AI: supervised machine learning.

According to FTI’s 2024 trend report: “JP Morgan Chase invested $100 million into developing sophisticated anti-fraud technologies for consumer payments, leading to a notable 14% decrease in fraud incidents between 2017 and 2021.” I think a reduction in fraud is a win for consumers as well.

The next area for ROI includes the automation of common processes within an organization, so-called back-office tasks. This includes such things as utilizing GPT-like tools to write thoughtful memos as well as creating an agentic workflow that can take one or more e-mails and documents to create a draft presentation. One large consulting firm is doing just that, I learned through some of my recent conversations.

The final area is around market growth. This is where innovation can become very exciting.

JPMorgan recently announced its release of Quest IndexGPT. This is an innovative application that uses AI in a customer-facing manner in financial services, representing a shift from back-office optimization to revenue-generating products. The Quest IndexGPT offering utilizes Large Language Models (LLMs) to generate relevant keywords for specific investment themes to generate relevant keywords for specific investment themes, identifying pertinent news and companies to improve the efficiency and accuracy of constructing investment indices.

It is currently being offered to institutional clients via the Bloomberg and Vida trading platforms. The business value potential is significant: additional institutional client adoption could drive greater index creation volume (especially with the reduced construction time), leading to increased revenue per index and expanded market share in the index business. This initiative aligns with JPMorgan's broader AI strategy across their global Strategic Indices business, demonstrating how AI can create new financial products while maintaining the rigorous standards required in financial services.

Mind you, my background is in aerospace and not finance, and I learned a lot just from this piece. What's particularly interesting is seeing how different industries approach AI adoption - while aerospace might prioritize safety and reliability in AI implementation, financial services seems to balance innovation with regulatory compliance and customer trust.

Enterprise Scaling Roadmap

As I mentioned earlier, JPMC has been transitioning into a “future-ready” state for (at least) 7 years, though I would argue it is more like 10 or 11. Creating and rearchitecting not just your tech stack, but also bringing a massive culture along on this journey is a lesson in the systems approach needed to getting here.

The bank has taken a top-down approach to adoption by adding a Chief Data and Analytics Officer to its leadership team.

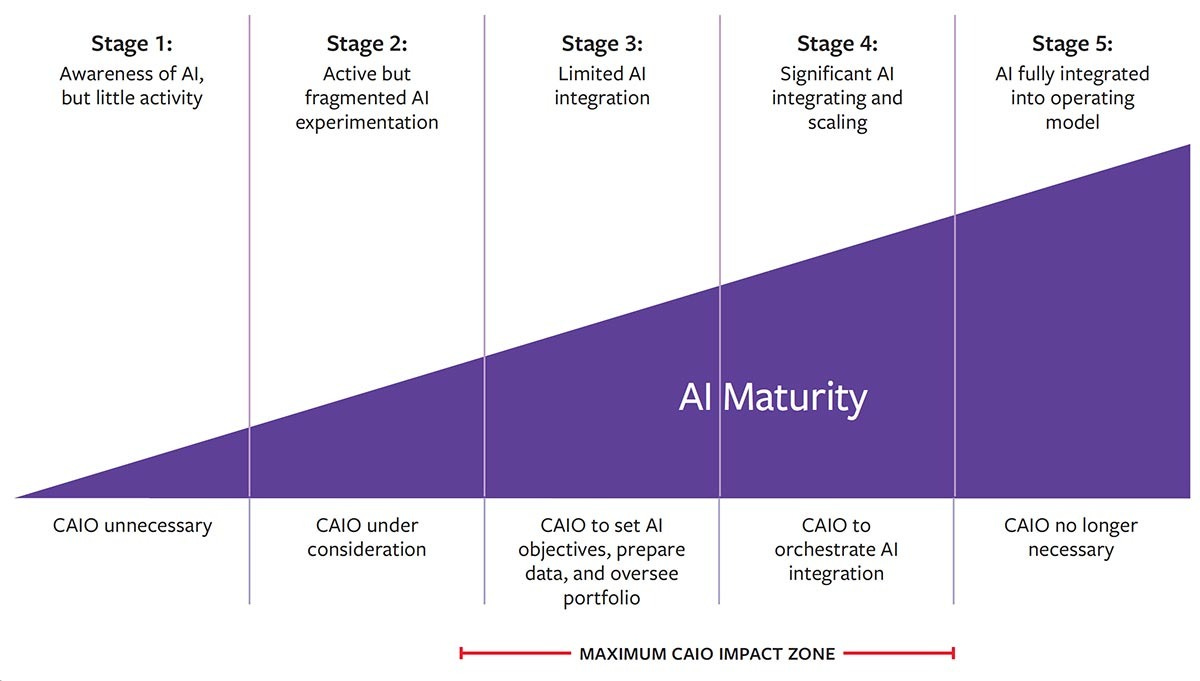

Is this a precursor to a scaled approach to enterprise AI innovation and adoption? As MIT Sloan Management Review recently reported: it really depends on the maturity of the organization.

There is definitely a place for these positions to ensure consistent and disciplined development and deployment across an enterprise. Fragmented use can lead to duplicative costs and potential security concerns. A centralized organization can ensure consistent policy, compliance, security and cost standards while measuring the real Return on Investment and qualitative business value that is being realized.

Looking Forward

JPMorgan's AI journey offers valuable lessons for any organization contemplating large-scale AI adoption. Their methodical approach - starting with infrastructure modernization, moving through back-office automation, and now advancing to customer-facing AI products - demonstrates that meaningful AI transformation is a marathon, not a sprint.

The addition of a Chief Data and Analytics Officer signals more than just a new leadership position - it represents a commitment to treating AI as a strategic capability rather than just another technology initiative. As organizations mature in their AI journey, this kind of dedicated leadership becomes crucial for maintaining consistency, ensuring responsible development, and driving measurable business value.

But perhaps the most important lesson from JPMorgan's story is that successful AI transformation requires more than just technology investment. It demands a systematic approach that addresses culture, governance, and business strategy in equal measure. As more organizations embark on their own AI journeys, JPMorgan's path - from careful infrastructure planning to innovative customer solutions - provides a valuable roadmap for balancing innovation with institutional responsibility. After all, in an industry where trust is paramount, JPMorgan's approach shows that even the most traditional institutions can embrace AI transformation while maintaining their core values and responsibilities to stakeholders.

What have you seen in your work and industry? I would love to hear more!

#AIStrategy #FinTech #DigitalTransformation #FutureOfFinance